GST certificate attestation

GST Certificate Attestation For UAE In India

Document attestation is mandatory for a person who is planning to take a business overseas or set up a new one in a foreign country like the UAE. It is a kind of confirmation of the business being real and legal which helps the business run smoothly in the commercial sector of the UAE. Among all the necessary documents, the GST Certificate is the one that shows your company is formally registered in India. A GST certificate needs to be attested first if it is to be used in the UAE.

GST Certificate Attestation is a type of commercial documents Attestation which goes through various officials and complexity. At UAE Attestation, we make the entire process smooth and quick. We handle all steps on your behalf, including the digital attestation process that helps you track progress in real time. Our UAE Attestation services are available all across Indian Major cities such as UAE Attestation in Bangalore, Mumbai, Kerala, etc.

What is GST Certificate Attestation?

A GST Certificate is a commercial document and it goes through an attestation process similar to educational and personal certificates. GST certificate verifies and shows your commercial identity. It confirms your company is registered with the Government of India and eligible for all types of tax compliance.

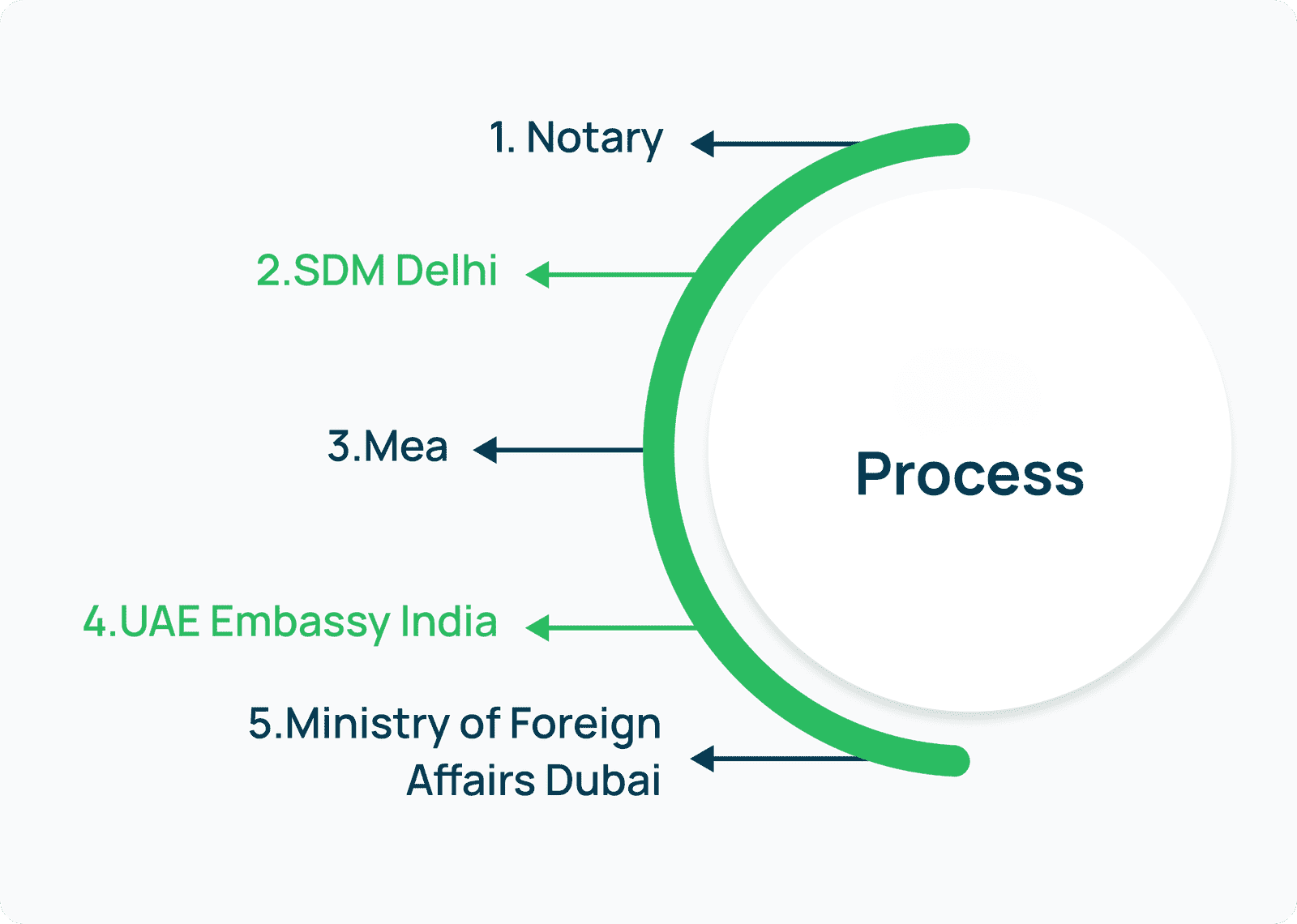

Process of GST Certificate Attestation for UAE in India

The attestation process involves several stages. The process starts from Notary, Chamber of Commerce, MEA, UAE Embassy, and finally ends with MOFA attestation.

- Notary Attestation: The first step of the attestation process is notary. A local notary verifies and certifies the GST Certificate.

- Chamber of Commerce Attestation: Now, the GST certificate goes to the Chamber of Commerce department. It confirms the authenticity of the commercial document.

- MEA Attestation in India – At the national level, the Ministry of External Affairs (MEA) provides an attestation stamp on the original GST document.

- UAE Embassy Attestation in India: The UAE Embassy in India checks and attests the GST document.

- MOFA Attestation (UAE): Finally, the Ministry of Foreign Affairs in UAE gives the last approval and attestation. After MOFA attestation, GST certificate is now legal and acceptable in UAE.

Since Digital attestation is now available from 9 September 2025, The process has become easier, faster, more secure, and more transparent. Each stage is mandatory for commercial document legalization.

Time Required for GST Certificate Attestation

The time frame depends on the method you choose for GST certificate attestation. With UAE Attestation, you can get your attested GST certificate in 5-7 working days.

Cost for GST Certificate Attestation

| Document Type | Price |

|---|---|

| GST Certificate | Rs. 7000 to Rs. 9500 |

The cost depends on urgency and the number of documents. Each official such as Notary and Chamber of Commerce can cost varied fees. At UAE Attestation, we provide the most affordable attestation services. Our fees are nominal and clear pricing with no hidden costs.

UAE Attestation & Apostille Application Submission

Send us your enquiry.

Apply for UAE Attestation

Need to submit inquiry through below step so, our representative will connect you...

Get a Quote

As soon as we receive your enquiry, one of our experts will get back to you & provide you a quotation asap.

Pickup & Submission of Document

Free document pickup & drop-off services across India, covering 25,000+ pincodes.

Documents Required for GST Certificate Attestation

You need various documents to start the attestation process. All documents must be valid and match the company’s legal details.

- Original GST Certificate (not older than three months)

- Passport copies of the company’s founder or directors

- Authorization letter

Why Is GST Certificate Attestation Required for UAE?

For any purpose, UAE authorities require attested documents to verify your legal status. Similarly, Without attestation, your GST Certificate will not be accepted for official use in the UAE. You need GST Certificate attestation for several reasons:

- To expand your business operations in UAE

- To apply for trade licenses or government tenders

- To export goods or services to UAE

- To avoid document rejection during legal procedures

- To open a branch office or sign trade contracts

FOLLOW THE STEPS FOR SERVICES

Getting your documents attested can be simple if you follow a systematic approach. At UAE Attestation, we ensure that we provide explicit and genuine services. Here are the steps to get started with our services.

Why Choose Us for GST Certificate Attestation for UAE?

UAE Attestation provides full GST Certificate attestation services for all who want to move their business abroad.

- Doorstep Pickup and Delivery: We collect and return documents safely.

- Digital Tracking: You can monitor progress online anytime.

- Faster Turnaround: Choose normal or urgent processing.

- Experienced Team: We handle Notary, CoC, MEA, Embassy, and MOFA.

- Safe Handling: We prioritize confidentiality and security.

- Customer Satisfaction: Thousands of businesses trust our service every year.

Attestation Stamp for UAE - GST Certificate Attestation

Each authority applies its own unique stamp or sticker on the GST Certificate in the attestation process. The Notary provides a signature and seal. The document is certified for use in commerce by the Chamber of Commerce. An exclusive rectangular attestation stamp is applied by the MEA. For UAE approval, the UAE Embassy adds its official seal. The legalisation process in the UAE is finally completed by MOFA attestation. These stamps prove that the document is genuine and ready for official use in the UAE.

Validity of GST Certificate Attestation

The attested GST Certificate is usually valid for three months. UAE authorities require a fresh GST Certificate if it is older. Re-attestation may be needed if asked for reconsideration. You can apply after the validity period again. Digital attestation records have made re-attestation faster and easier.

Challenges in GST Certificate Attestation

Many business owners face issues during the gst attestation process. The attestation process is not one step. It is a time consuming and complex process. Still there can be various challenges such as:

- Certificate older than three months gets rejected

- Delays at Chamber of Commerce or MEA

- Errors in company name or GST number

- Misplaced documents during courier or manual handling

- Confusion in embassy procedures

We WorkFor

Frequently Asked Questions

Yes, for non-Hague countries. For UAE, both apostille and embassy attestation may be required.

It is a rectangular sticker from MEA proving authenticity for use abroad.

Yes. UAE Attestation offers secure digital tracking throughout the process.

Why Choose UAE Attestation?

Customer Support

UAE Attestation has 24x7 support* to assist you at any point you need help.

100% Genuine Stamps

UAE Attestation provide 100% Genuine Stamping Services on all type Document. Sign & Stamp By under Section Officer and ambassador.

Document Safety & Security

We Have a Professional Dedicated Team at Ground Level For Specially Handling Original Documents.

Document Tracking

UAE Attestation provides live document tracking Services once the documents are submitted, so that you are aware about current process.

Real Customer Feedback.

Srinivas Kondan

3 Day ago

The UAE Attestation team made the whole embassy attestation process quick and stress-free — highly recommend!

Madhur Chauhan

7 Day ago

They handled my birth certificate attestation for UAE with such professionalism that I didn’t have to worry about a single detail.

Durjay Ray

9 Day ago

Thanks to their prompt service, my marriage certificate attestation for UAE was attested in no time.

Tisha Sharma

4 Day ago

The team guided me at every step and got my degree certificate attestation for UAE faster than I expected.

Aleeza Beylim

8 Day ago

Their MOFA attestation service was smooth, transparent, and delivered exactly on time.

Brindha Bhaskar

6 Day ago

I’m based in Mumbai and they collected my documents, got them attested, and delivered them back without me lifting a finger.